How Much Money Do I Need to be Rich?

Most Americans define ‘rich’ as anyone that makes more money than they do. I define it like this:

Rich /ˌriCH/ adjective

- The point at which your investments generate enough income to cover your expenses; working for a paycheck is optional.

- “She can do whatever she’d like with her time because her expenses are covered by a portion of the money her portfolio generates; working for a paycheck is now optional.”

- Synonyms: financially independent, FIRE, wealthy

- See also, F**k you money

How Much Money Do I Need To Be Rich?

Being rich means something different to everyone but rich doesn’t mean cruising around in your limo, dressed up like Mr. Peanut or Rich Uncle Pennybags. Rich is not living like the upstairs people at Downton Abby.

Rich IS having enough money to buy your freedom. Freedom is the ability to do whatever you want to do with your time.

Freedom is the best thing your money can buy and figuring out how much that freedom will cost you is pretty easy.

How Much Do You Need To Retire Early?

It turns out that your financial freedom will cost you about 25 times you annual expenses. Take your annual expenses and multiply that by 25 to get your magic number.

If you can live on $20,000 per year, then your magic number is $500,000 ($20,000 x 25). If you need $100,000 per year to get by, then your number is $2.5 million ($100,000 x 25). Once you build up a portfolio that is equal to 25 times your expenses, then you’ll be able to retire early.

What Is The 4% Rule

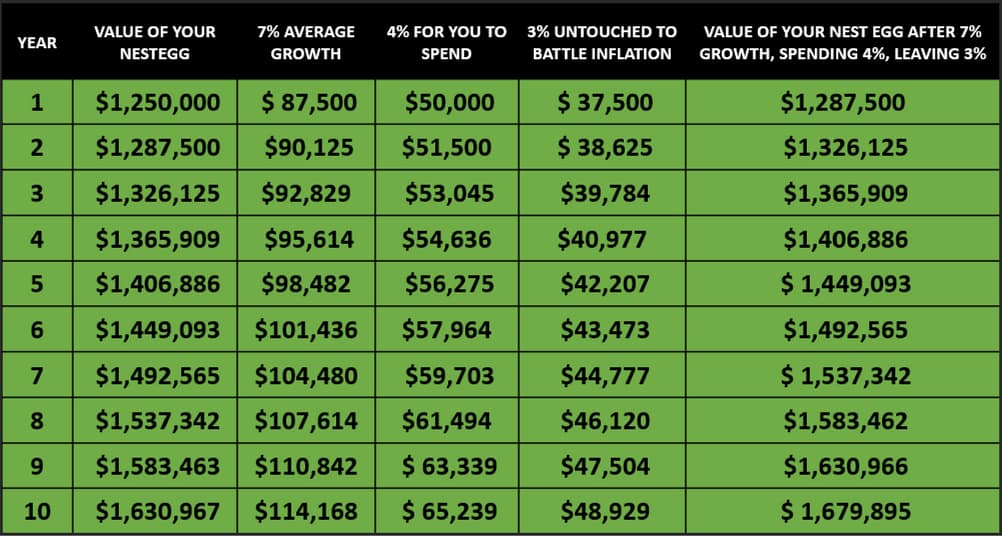

The 4% Rule says that on average your stock market investments will grow at 7% per year. From that 7% growth, you’ll be able to spend 4% and leave the remaining 3% invested in order to keep up with the average rate of inflation.* In theory, you never touch your principal investment, only a portion of the growth.

As you can see from the table below, if you only spend 4% and leave the remaining 3% invested, you’ll have enough money to live on for the rest of your life, while keeping up with inflation.** And this is important because we know that a dollar today is worth more than a dollar tomorrow!

Or you if you don’t want to do any math you can use this calculator:

- To use the calculator start by entering the amount of your expense in question (by default this is $100).

- Next, use the drop down menu to choose whether this expense is daily, weekly, monthly or yearly.

- Finally, use the slider at the bottom of the calculator to choose your safe withdraw rate. 4% is the default, but some plan on withdrawing more or less from their portfolio. Pick the SWR that works for you.

How Long Does It Take To Get Rich

The time it will take you to become rich (a.k.a. “financially independent”) depends upon a few things, namely:

- The amount of money you need to live on. The more money you need to get by, the more you’ll need to save in order to meet this need. Inversely, the less money you need to get by, the less you need to save up.

- The percentage of your income that you save. If for some reason you can’t save any money whatsoever, then your savings rate is 0% and you’ll never be financially independent, because you’ll always need a paycheck to get by. If you’re on the opposite end of that example and you’re able to save 100% of your income, then you’re already there. Congratulations!

With this information you are now in total control – figure out how much money you need to get by each year, then save up 25 times that amount. The second your expenses are covered by your investments, you are free to do whatever you want to do with your time because once you’ve reached this point, your money has purchased your freedom and you are officially rich!

Want to keep grinding away at your current job? Go for it!

Want to become a Walmart Greeter? Knock yourself out.

Want to lay on a beach doing nothing? Volunteer at a non-profit? Search for Bigfoot in the Pacific Northwest?

When your assets generate income that is greater than your expenses you can do whatever you want!

Notes & Updates

* The stock market is like an EKG machine and not like an up-moving escalator. Some years your investments will not only miss the 7% growth rate, but you’ll actually LOSE money that year. Yikes – that’s scary! But don’t panic just yet because other years your investments will grow at a MUCH greater rate than 7%. That’s why I’ve bolded the word average, because it all evens out. Over time the stock market always goes up. By an average of 7% annually, after adjusting for inflation. If you want to read and learn even more about how simple and easy saving and planning for retirement can be, I highly recommend this book, The Simple Path to Wealth, by Jim Collins, which is easy to read and understand. I own it and refer to it often:

**The 4% rule is also sometimes called the Safe Withdrawal Rate, which is to say “how much money can I safely withdraw from my account without fear of every running out?” 4% is that amount, but I’ve only scratched the surface of the 4% rule in this post. Here are some additional posts on this controversial topic, some with differing points of view, that I recommend you check out:

- The 4% rule: The easy answer to ‘How much do I need for retirement?’ by Mr. Money Mustache

- Safe withdrawal rate for early retirees by Mad Fientist

- Understanding sequence of returns risk – Safe withdrawal rates, bear market crashes, and bad decades by Michael Kitces