How to Calculate Retirement Costs for Anything

Not long ago I was looking over my expenses when I had a financial epiphany of sorts. It was about the true retirement costs of my spending habits.

I recently wrote a post about how I’m going broke from eating out. In that post I tried to quantify just how expensive my +$6,000 per year dining out habit really is, and this is what I came up with: not only do I spend over $6,000 per year eating out, but maintaining that habit in retirement means that I need to boost retirement accounts by $150,000.

How to Calculate Retirement Costs for Anything

I don’t know how long you would need to work just to save $150,000, but saving that kind of dough would take me multiple years. I don’t enjoy eating out so much that I’m willing to add a few additional YEARS to my working career just so that I can keep spending $6,000 per year in mediocre restaurants.

That is the dark side of the Personal Finance Multiplier Effect in action.

Running the Numbers

Figuring out how $6,000 per year requires $150,000 in investments savings is pretty simple. There are two easy ways to calculate the true cost of something:

- Annual expense divided by .04

- In my case I spend about six grand per year eating out, so that would be $6,000 / .04 = $150,0000. Or,

- Annual expense multiplied by 25

- Again, using my restaurant bill as the example, $6,000 x 25 = $150,000.

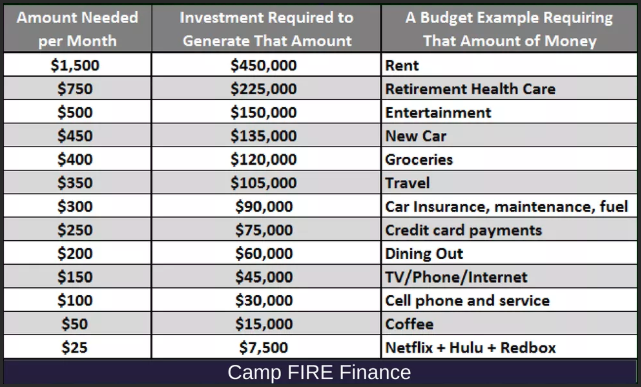

Using the Rule of 25 and the 4% Rule, this cheat sheet will help you figure out exactly how much money you’ll need to have saved and invested for your retirement:

It’s Mathemagical

Some of you might recognize that I’m using math from the 4% rule to come up with these numbers.

For those of you not familiar, the 4% rule is a way of estimating how much money you’ll need to save and invest for retirement so that you can maintain your lifestyle without running out of money. To calculate that number, simply take your total annual expenses (housing, transportation, fast food, cable, cell phone, clothing, entertainment, etc.) and multiply that number by 25.

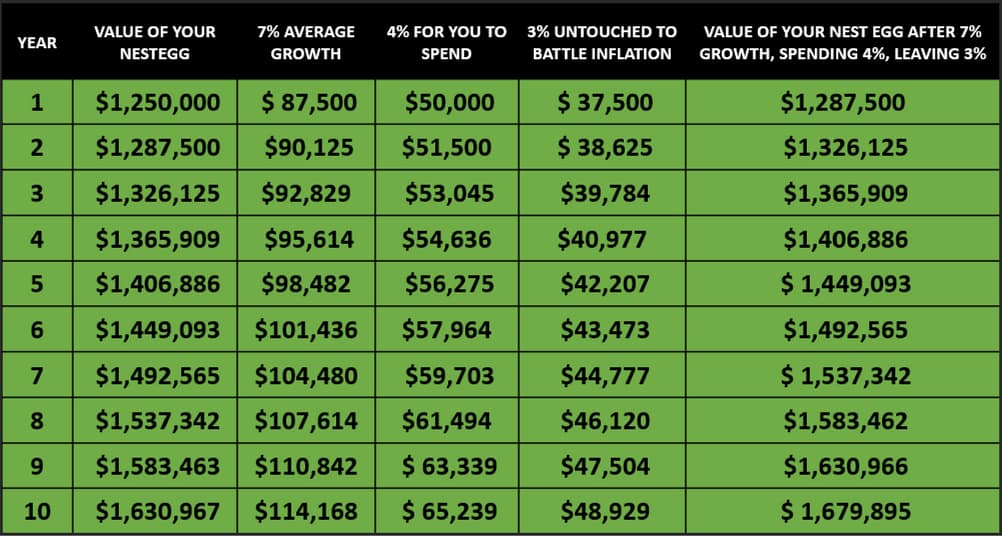

The number you get is how much you’ll need to save and invest. In a nutshell, here’s how it works: The stock market grows at an average rate of 7% per year while inflation grows at an average rate of 3% per year.

From that 7% investment growth you’ll be able to withdraw 4% to meet your annual expenses and leave 3% behind to keep up with inflation, meaning your nest egg should remain healthy throughout your retirement. Take a look at this example:

Retirement Cost Examples

Based on math from the 4% Rule, also known as the Safe Withdrawal Rate, you will need to have $100,000 invested to support any habit or hobby that costs you $4,000 per year (or $333 per month, or $11 per day).

Here are some typical expenses people have that will significantly increase the amount of money they’ll need need to have saved for retirement.

You can play with this retirement cost calculator to determine the true retirement cost of items in your budget.

How to Use The Retirement Cost Calculator

- Enter the amount of your expense (by default this is $100).

- Use the drop down menu to choose whether this a daily, weekly, monthly or yearly expense.

- Finally, use the slider at the bottom of the calculator to choose your safe withdraw rate. 4% is the default, but some plan on withdrawing more or less from their portfolio. Pick the SWR that works for you.

Save More or Spend Less

These are some pretty general examples, but you can see that if you’ve got a hobby or expense that costs you $300 per month, then you’ll need to have $90,000 in your retirement account just to support that one single hobby.

When it comes to saving for retirement, there are two levers that you you can pull:

- Earn more money

- Cut expenses

The less you need to get by, the less you need to save up to retire.

Think Differently

I can here the boo birds already: “I’m not going cut all of my expenses only to live a life of boredom and/or destitution!” My reply: Good for your – neither am I.

My goal for this post is to help you frame up future purchases a little bit differently so that you can be aware of the true costs of an item or service. Even small purchases can quickly add up, requiring you to add years to your working career just so you can support your lifestyle of choice.

Or, You can retire earlier than you think. You just need to start thinking differently.

Run The Numbers

Before making your next purchase, or signing for that next loan, or joining that next subscription service take 10 seconds to figure out how much this new item will cost you per year, multiply that number by 25, and ask yourself if you’re willing to save that much money just to support whatever it is you’re buying.

And on the flip side, take a look at your expenses. Don’t be like me and assume you know how much you’re spending. Begin to track every penny you spend, cut unnecessary expenses from your budget, and cut unnecessary working years from your life.

Every $350 per month that you can eliminate from your budget reduces your ‘magic retirement number’ by $100,000.

How long will it take you to save $100,000?

How long would it take you to cut $350 from your budget?

Chime in!

Were you already aware of the true cost of some of your hobbies and habits? Was this a surprise to you?