Index and Chill – The Safe and Easy Way to Invest in the Stock Market

The best way to build wealth and achieve FIRE is to invest your money. The best way to invest your money is to index and chill!

Cash Is Not A Safe Investment

Despite what you may think, cash is not a safe investment. Each year the dollar loses about 3% of its buying power due to inflation. $1.00 today will be worth $0.97 cents next year, then $0.94 the next …

If your strategy to build wealth is to invest in cash, you probably need a new plan. Besides, cash is not an investment anyway. Investing is the act of spending money with the expectation of receiving more money in return, and while saving money is a good idea, it’s hardly safe and you certainly won’t get more cash in return. In fact, saving alone is a guaranteed way to lose money.

Stocks Are A Safer Investment

You’ve also probably heard that stocks are risky, but that’s an incomplete statement. Investing in individual stocks is what’s risky. Consider this: 88% of the Fortune 500 firms from 1955 are gone! Only 61 of those formerly “blue chip” firms are still on that list today.

That sounds brutal! So how can I say that the stock market is safer? Because of this: there is a limit to how much damage one company can do to the stock market, but there isn’t a ceiling on how much value one company can contribute.

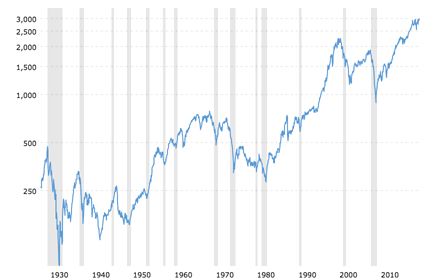

Bad companies go away (Radio Shack) while solid companies stick around (Amazon, Microsoft, Apple), that’s why over time the stock market always goes up! Sure this upward march looks more like an EKG machine and less like an up-moving escalator, but the trend is very clear: up and to the right.

Source: Macrotrends – S&P 500 Index – 90 Year Historical Chart

And the stock market is resilient as well! Over the past hundred years nothing has permanently sunk the U.S. stock market. Not:

- The Great Depression

- World War I

- World War II

- The Korean War

- A presidential assassination

- The Vietnam War

- A failed presidential assassination

- The War on Drugs

- The Gulf & Iraq Wars

- 9/11

- The War on Terror

- The Great Recession

- Saber rattling with North Korea

Some individual companies failed, but the market did not! Some years the market is up, some years it’s down. But over the long term, the up years far outweigh the down years.

S & P Index – 90 Year Historical Chart

Index And Chill

To rapidly build wealth you need to do more than just save your dollars – you need to put them to work someplace safe where they can grow and multiply. One of the safest ways to do this is by investing in the entire U.S. stock market rather than individual stocks.

To invest in the entire U.S. stock market you buy index funds. Every major investment firm offers a total stock market index. Two of the most popular are the Total Stock Market Index from Vanguard and the Total Market Index Fund from Fidelity. Both of these options have low fees and by purchasing one share of an index fund you’re essentially buying a piece of every single publicly traded company in America.

After you’ve bought your index fund, keep buying more. Make it your business to buy index funds then just sit back and watch your money making machine go to work for you. All you need to do is index and chill and watch your net worth climb up and to the right!

Chime in!

I try to keep my posts short and sweet, but love it when the conversation continues below in the comment section. What do you think of Index and Chill? Are you an index investor? Do you have individual stocks? What’s your investment strategy?