Acorns Micro Investing App Review

Acorns Review summary:

Full disclosure: Camp FIRE Finance is an affiliate for Acorns.

ACORNS: Invest Your Spare Change

WHAT IS ACORNS? Acorns is a “mico-investing” service that allows you to invest your spare change into the US stock market. The app connects to your checking and credit card accounts and your purchases get rounded up to the nearest dollar. Those “round-ups” are then placed into an investment account for you. You’re free to withdraw your money whenever you’d like, as often as you’d like with no fees or penalties.

WHAT’S GOOD ABOUT ACORNS? Easy to set up and get started, with no minimum balances required. This is a great way to begin investing in the stock market. The automation aspect means you don’t have to think about it.

WHAT’S NOT SO GOOD ABOUT ACORNS? The web interface isn’t as good as the mobile app. Fees can get high. Tax time can be a hassle when you’re waiting on IRS documents for a relatively small balance.

COST TO USE ACORNS: $1 – $3 per month, depending on your plan; free for students.

WHERE TO GET ACORNS: Get a $5 bonus when you create your account using this link.

RATING: ![]()

![]()

![]()

![]()

What is Acorns?

When I was younger (in my 20’s) I had a difficult time leaving my saved money alone. Save, spend my savings, repeat. I’m pretty sure I’m not the only person that’s struggled with that cycle. A couple of years ago I stumbled onto Acorns, a service so awesome and simple that I was upset with myself for not thinking of it first.

Acorns is like a piggy bank for adults. The concept is easy to understand and simple to use. Defined as a ‘micro-investing’ service, Acorns allows you to invest your spare change into a portfolio of index funds. This is done by connecting your checking and credit card accounts to your Acorns account. Whenever you make a purchase using your connected bank accounts, that transaction gets rounded-up to the nearest whole dollar amount and this ’round up’ is invested.

A $4.75 purchase gets rounded-up and you invest $0.25. Simple.

In addition to round-up investments, you can also make lump sum deposits into your Acorns account, or even set up a recurring investment – like $25 every other Friday.

Investing Your Spare Change

Money makes its way into your Acorns account in one of three ways.

- Through transaction round-ups

- With lump-sum deposits

- From recurring deposits

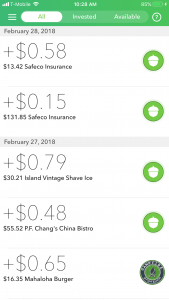

Acorns Round Ups

Round-ups can be done automatically on 100% of your transactions or, if you prefer the manual approach, you can log in to your Acorns account and manually approve specific transactions that you want to round up, and exclude those which you don’t.

Round-ups can be done automatically on 100% of your transactions or, if you prefer the manual approach, you can log in to your Acorns account and manually approve specific transactions that you want to round up, and exclude those which you don’t.

That’s too much work for me so I’ve automated the process and all my transactions get rounded-up automatically. On those occasions when an even dollar amount is spent you can direct Acorns to either ignore it or round it up by a full dollar (I’ve chosen to do a full dollar round-up).

Acorns also offers you the ability to look back at historical transactions from each one of your linked accounts and choose whether or not you’d like to round them up. I happened to create my account mid-month and chose to round-up all of my transactions from the beginning of the month. Doing this allowed me to start with about two weeks of historical transnational worth $24.25 in round-ups. I only looked back about two weeks, but you can go back as far as you’d like to.

To round-up historical transactions, simply click on the “Round-Ups” tab from the app menu, scroll through your transactions and touch the transactions you’d like to round-up.

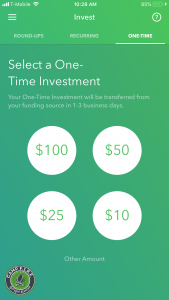

Lump Sum Deposits

In addition to the transnational Round-ups, Acorns also offers users the ability to do single, lump-sum deposits. These deposits can be done at any time and for any reason. There isn’t a limit on the number of deposits you can make via this method.

In addition to the transnational Round-ups, Acorns also offers users the ability to do single, lump-sum deposits. These deposits can be done at any time and for any reason. There isn’t a limit on the number of deposits you can make via this method.

Personally I like to use this feature to lock in any ‘savings’ that I get in my day-to-day life. For example, during the work week I usually eat out for lunch, which costs be about $10 each time. This adds up quickly, so when I bring my lunch from home I like to do a lump-sum deposit to capture that $10.00 that I saved by brown bagging it.

To round-up historical transactions, simply click on the “Invest/Withdraw” tab from the app menu, type in the lump-sum you’d like to save, and click the ‘invest’ button.

Lump sum deposits are available only with the $2.00 and $3.00 per month plans.

Recurring Deposits

The last way for money to find its way into your Acorns account is through a recurring deposit. This is as straightforward as it sounds. You can schedule a lump-sum amount to be deposited on a regular daily, weekly, or monthly basis.

The last way for money to find its way into your Acorns account is through a recurring deposit. This is as straightforward as it sounds. You can schedule a lump-sum amount to be deposited on a regular daily, weekly, or monthly basis.

To schedule a recurring investment, click on ‘Settings’ from the app menu and then select ‘Recurring Investment.’

Once you’ve created your account and chosen how to get the money flowing, all that’s left for you to do is sit back and watch your spare change add up. Due to the “micro-investing” nature of the Acorns program, you’re dealing with small numbers that will build slowly, much like an acorn growing into a mighty oak (y_eah, I went there!_). So this isn’t huge money we talking about here, but that’s exactly why I like Acorns so much.

Because you’re investing spare change, it’s a painless and easy way for you to do *something,* which is great for those of us looking for creative ways to squirrel away cash.

Recurring deposits are available only with the $2.00 and $3.00 per month plans.

Investment Portfolio Options

Round-ups are moved into your Acorns account in $5.00 increments. So if the value of your last six round-ups is $4.15, that money will remain in your bank account until you’ve got another $0.85 in round-ups. Once that $5.00 threshold has been met, the money will flow into your Acorns account and get invested in your portfolio. There are five portfolios available to you which range from Conservative to Aggressive.

Here are the five Acorns Smart Portfolios options, with more details and screenshots below:

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

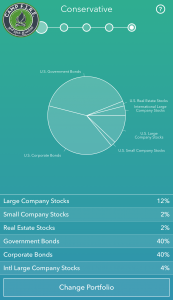

Conservative Acorns Portfolio

The Acorns Conservative Portfolio “seeks to provide investors with current income and preservation of capital.” The investment breakdown looks like this:

The Acorns Conservative Portfolio “seeks to provide investors with current income and preservation of capital.” The investment breakdown looks like this:

- 40% Government Bonds

- 40% Corporate Bonds

- 12% Large Company Stocks

- 4% International Large Company Stocks

- 2% Small Company Stocks

- 2% Real Estate Stocks

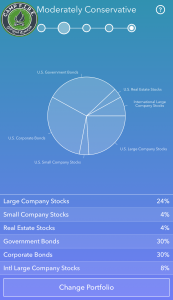

Moderately Conservative Acorns Portfolio

The Acorns Moderately Conservative Portfolio “seeks to provide investors with current income and capital appreciation.” The investment breakdown looks like this:

The Acorns Moderately Conservative Portfolio “seeks to provide investors with current income and capital appreciation.” The investment breakdown looks like this:

- 30% Government Bonds

- 30% Corporate Bonds

- 24% Large Company Stocks

- 8% International Large Company Stocks

- 4% Real Estate Stocks

- 4% Small Company Stocks

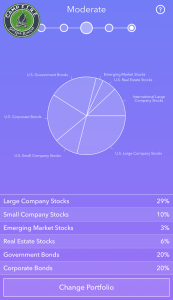

Moderate Acorns Portfolio

The Acorns Moderate Portfolio “seeks to provide investors with capital appreciation and current income.” The investment breakdown looks like this:

The Acorns Moderate Portfolio “seeks to provide investors with capital appreciation and current income.” The investment breakdown looks like this:

- 29% Large Company Stocks

- 20% Government Bonds

- 20% Corporate Bonds

- 10% Small Company Stocks

- 6% Real Estate Stocks

- 3% Emerging Market Stocks

Moderately Aggressive Acorns Portfolio

The Acorns Moderately Aggressive Portfolio “seeks to provide investors with capital appreciation.” The investment breakdown looks like this:

The Acorns Moderately Aggressive Portfolio “seeks to provide investors with capital appreciation.” The investment breakdown looks like this:

- 38% Large Company Stocks

- 14% Small Company Stocks

- 10% Government Bonds

- 10% Corporate Bonds

- 8% Real Estate Stocks

- 4% Emerging Market Stocks

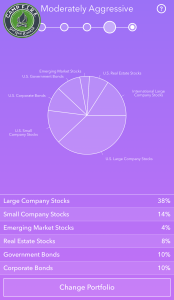

Aggressive Acorns Portfolio

The Acorns Aggressive Portfolio “seeks to provide investors with capital appreciation.” The investment breakdown looks like this:

The Acorns Aggressive Portfolio “seeks to provide investors with capital appreciation.” The investment breakdown looks like this:

- 40% Large Company Stocks

- 20% Small Company Stocks

- 20% International Large Company Stocks

- 10% Real Estate Stocks

- 10% Emerging Market Stocks

When creating your Acorns account, you’ll be asked a series of personal questions. The answers you provide are used to recommend an investment portfolio. Acorns recommended a Moderate Portfolio for me, but my risk tolerate is pretty high so I chose to go with an Aggressive portfolio instead. To change portfolios, select ‘Settings’ from the app menu, then choose ‘My Acorns Portfolio.’ Swipe left and right to see your options.

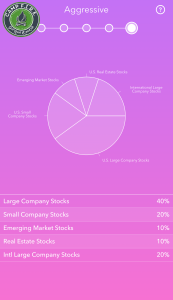

Signing Up For Acorns

Creating an account took me less than five minutes to complete from my mobile device (the process was just as quick and easy on a PC). While signing up you’ll need to do and provide the following:

- Provide a valid email address, which later serves as your account login ID

- Create a robust password

- Agree to Acorns’ terms and conditions

- Answer several questions about yourself, like what’s your income, net worth and employment status?

- Acorns uses this information to recommend an index fund portfolio which your round-up will be invested into

- Link your bank accounts to your Acorns account

- Through the Acorns secure interface, you’ll provide your bank account username and password

- Lastly, you’ll be asked to provide your personal information like name, phone number, mailing address, and social security number

Acorns Signup Process

This personal information is required by law whenever you open a financial account, so don’t be alarmed when you’re asked to provide your social security number.

Acorns User Interface

You can access your Acorns account via a web-based app or through a mobile device app on your tablet or smartphone. The mobile app is superior to the web interface in terms of functionality and ease of use, so that’s what I’m going to focus on here.

From this dashboard you’re able to access the following:

- Round-Ups is where you’ll be see historical transactions in your account

- The Invest/Withdraw tab allows you to make lump-sum deposits and set up recurring deposits to your account

- History tells the story of your Acorns account, including

- total amount invested and withdrawn

- Dividends earned

- Total account gain/loss

- Found Money

- Referral bonuses

- The Performance tab shows you how your portfolio is performing. You can view this in 1 day, 1 month, 6 month, 1 year, or All time historical views

- Found Money is a new Acorns feature where you can earn money by shopping with Acorns’ partners

- Grow is the Acorns blog and news portal

- Invite Friends, Get $5 is the Acorns referral program

- Settings is where you can manage all aspects of your Acorns account

A snapshot of my history with Acorns

Other features

Found Money and Grow are two features I want to point out, and are both relatively new to Acorns.

Found Money is a shopping portal that will add money to your Acorns account when you shop and buy with retailers that Acorns has partnered with. Acorns has several well-known partners and while I’ve not personally used this service, it does look intriguing. If I ever decide to ‘cut the cord’ on my cable TV then I’m sure I’d sign up for Hulu – why not sign up via Acorns and have 20% of my Hulu bill automatically invested back into Acorns for me?

Shop with Acorn’s partners and they’ll deposit money into your account

Grow is Acorns’ blog/magazine and is geared toward new investors. The financial content on the site is well-written and easy to grasp. Recently Acorns integrated the Grow content into the mobile app, which is a nice addition.

Acorns Pricing and Fees

The basic Acorns account costs $1.00 per month. There is also a $2.00 per month option and coming in 2018 there will be a third account option that will cost $3.00 per month. Here’s a breakdown of what you get.

Acorns $1.00 Per Month Plan

For one buck per month here’s what you’ll get:

- Automated investing (aka round-ups)

- Smart Portfolios (access to one of the five portfolios I mentioned above)

- Grow Magazine

- Found Money (currently over 200 brands that will add money to your account when you shop with them)

- Here For You (a fancy way of saying, ‘Acorns customer service’)

Acorns $2.00 Per Month Plan

For two dollars per month you’ll get everything that comes with the $1.00 plan, plus the following:

- Your IRA (Acorns will recommend an IRA that’s right for you)

- Recurring Contributions

- Anytime, Anywhere (this is the lump-sum deposit feature)

Acorns $3.00 Per Month Plan

For $3.00 per month you’ll get everything that comes with the $2.00 plan, plus something called “a new way to grow.” Apparently more on this will be revealed sometime in 2018.

Unless you’ve got a million dollars or more invested with Acorns, this is their pricing structure. I have nowhere near $1,000,000 invested with Acorns so I’m not sure what that pricing looks like.

Students (under the age of 24) can use the service for free if they register using their .edu email address.

Acorns Fees

$1.00 per month isn’t going to break anybody’s bank, but when you look at those fees as a percentage of your account balance, Acorns can be relatively expensive for some. For example, if you’ve only got $10.00 in your account then that seemingly small $1.00 fee becomes a 10% fee. That’s insane.

Acorns wasn’t designed to be your main investment vehicle, so as long as you’re using the service as a way to make your own savings more efficient by capturing your spare change, then personally I’m okay with the fees.

Is Acorns Safe?

Acorns provides bank-level security on their servers, which are also protected with physical security. The website and app are secured with 256-bit encryption and, in the unlikely event that something does happen, rest easy knowing that your money is SIPC insured for up to $500,000.

For good measure, your account has multi-factor authentication and automatic logouts should you leave your account open for too long without any activity.

Summary

![]()

![]()

![]()

![]()

I give Acorns a rating of 4 campfires out of 5. I withheld one campfire because the fees can be disproportionately high if you have a low balance. Also the tax documents can be a hassle; I don’t like dealing with the extra paperwork for the relatively small amount of money I keep with Acorns.

But those are minor problems for me. overall I really like Acorns and think that you will too. The mico-investing nature of the service means you’re not going to rapidly accumulate wealth, but it also makes saving painless. The small dollar amounts with no minimum investment required is a great way for beginners to dip their toes into the waters of stock market investing.

Ready to get started? You’ll get a $5.00 bonus for using this Camp FIRE Finance link when you create your Acorns account.

Other FinTech Reviews

Check out some of the other personal finance products and services that we’ve reviewed.